This cookie policy should be read together with our Privacy Policy.īy continuing to browse or use our sites, you agree that we can store and access cookies and other tracking technologies as described in this policy. This cookie policy explains how and why cookies and other similar technologies may be stored on and accessed from your device when you use or visit websites that posts a link to this Policy (collectively, “the sites”). understands that your privacy is important to you and we are committed for being transparent about the technologies we use. Check Business Breaking News Live on Zee Business Twitter and Facebook.

Get Latest Business News, Stock Market Updates and Videos Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage.

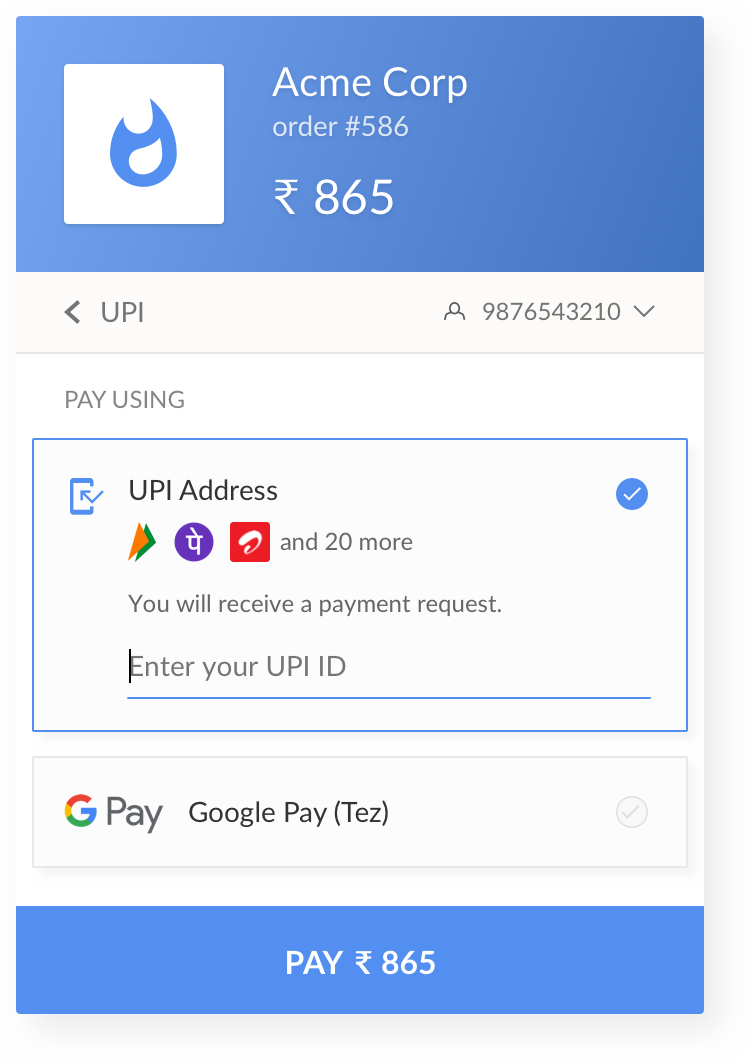

UPI also has a high payment limit as compared to PPI. UPI is primarily used for Peer to peer transfers and merchant payments, while PPIs are often used for bill payments, online shopping, and other transactions. UPI transactions are real-time transactions between two bank accounts, whereas PPI transactions involve prepaid payment instruments like mobile wallets, gift cards, and other virtual payment modes. Only the UPI transactions that are above Rs 2000 made to a merchant through PPI wallets while shopping, dining, etc will have an extra charge at the merchant’s end.” How PPI is different from UPI payments? It is also not likely to affect small merchants as most of the normal day-to-day transactions are below Rs 2000. All peer-to-peer transactions using GPay, Paytm and PhonePe shall remain unaffected. Many have a common question that will it impact people using payment options like GPay, Paytm and PhonePe? Ameet Venkeshwar further said, “it will not impact customers.

The extra charge will be borne at the merchant’s end," Venkeshwar said. This only applies to UPI transactions made to a merchant. All bank-to-bank transactions will still remain free of any charges. This will also be applicable while loading the digital wallets using the UPI mode. “Any transaction above Rs 2000 and done through UPI using PPI mode only that is using any digital wallets like Paytm, PhonePe, etc will be charged at 1.1 per cent.

0 kommentar(er)

0 kommentar(er)