You can apply for Withdrawal Benefit or Scheme Certificate through Form 10C for retaining the Pension Fund Membership. If you have more than 10 years of contribution to EPS you will get a Scheme Certificate. Withdrawal from Employee Pension Scheme, EPS, depends on if you have more than 10 years of contribution to EPF. You can withdraw EPF both the employee and employer contribution by submitting Form 19. Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS, EDLI, Employee Deposit Linked Insurance Scheme, How to get information about EPF balance : Annual Statement, SMS, E-Passbook discusses the basics of EPF ,EPS and EDLI. If person passes away while in service or before claiming EPF and EPS, his family can claim EPF & EPS. You can withdraw from EPF and EPS if you are unemployed for 2 months. You can also wait for two months to get a new job and then you can get your PF Account transferred to the new Account. However, in case of not getting the job, apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative. This video was published in Sep 2015 before the New Guidelines for Form 15G/15H were introduced. The YouTube Video on How to Fill Form 15G/15H online from State Bank of India Tutorials shows how to Submit Form 15H/Form 15G online.

In case of Joint Accounts, form 15 G/H will be generated for the first account holder.Form 15 G/H will be generated branch- wise.The forms required for different categories have been listed below : However, these forms must be maintained by the Deductor for a period of 7 years from the end of the financial year in which these are received.

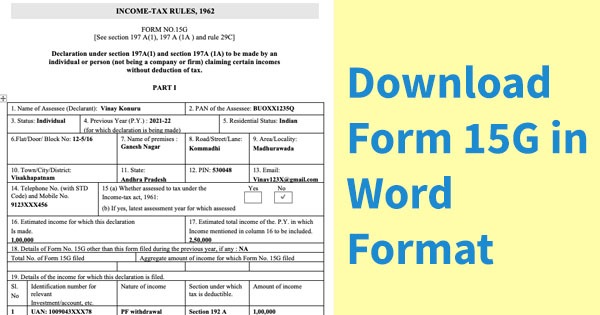

The Deductor shall mention the particulars of these Form 15G & Form 15H received during any quarter of the financial year along with the unique identification number allotted by him in TDS Quarterly Statements, whether or not any TDS has been deducted by him.The person responsible for making a payment or the Deductor shall allot a UIN (Unique Identification Number) to each Form 15G and Form 15H received.However, It seems Form 15G & 15H can be filed using Internet Banking facility or Similar facility for in case of Other institution which are making payment as provided in Section 197(1) or 197(1A) or 197(1C). No procedural rules has been prescribed as regard to filing of Form 15G. Introduction of Electronic mode of filing Form 15G & 15H as an Alternate to Paper Form.Gone are the various schedules like Schedule 1,2 etc Our article How to Fill Form 15G? How to Fill Form 15H? discusses the process of filling form 15G/15H in detail. The Income Tax Department has announced a new procedure regarding Form 15G & Form 15H starting 1 st October 2015. Key Changes are given below. Banks which allow submission of Form 15G & Form 15H Online.

0 kommentar(er)

0 kommentar(er)